Non Participating Whole Life Insurance Policy

There are purists who claim it’s the only way to go. Non participating whole life insurance is not owned by mutual insurers and typical policies do not receive policy dividends.

IN201 Auto Insurance Basics wholelifeinsurance

Whole life policies that earn dividends generally do so annually at the policy anniversary date.

Non participating whole life insurance policy. A participating life insurance policy is a policy that receives dividend payments from the life insurance company. What is a non participating life insurance policy? Participating whole life insurance has certain drawbacks such as:

The free dictionary defines it as a life insurance policy in which the policyholder does not have the right to receive a portion of the investments that the insurance company makes with policyholders premiums. Not only it helps grow the cash value, but also the death benefit. The better the company you bought does, then the more they will share with you.

When a life insurance company does business, they will sometimes earn extra profit from the investments that they choose. Non participating whole life insurance is typically seen in smaller final expense insurance policies , although there are some companies that offer larger whole life policies that do not receive. It is called participating because it is entitled to share or “participate” in the surplus earnings of the life insurance company.

Essentially, with participating whole life policies a risk does exist, but. Death benefits, premiums and cash surrender values are all determined when the policy is purchased. This means that the onus is on the life insurance company to pay out the cash value if the client so chooses, instead of on the client to choose the right type of investment vehicle for their insurance.

Prior to the 1980s, it was the only method used by companies that issued participating whole life insurance. Expect to pay anywhere five to 15 times more. And compared to term life insurance, participating life insurance is significantly more expensive.

Although this may initially sound like bad news, it is not necessarily. With a participating policy, the life insurance company is going to share some of the profits with this type of policy holder. However, policy form numbers do vary state by state.

Participating life insurance allows you to participate in the ownership of the company and share in the profits through dividends. You will receive a dividend that helps the policy grow. Participating means that you participate in the performance of the company.

If fewer people pass away than their underwriters have predicted, they also might have extra profit. These profits are shared in the form of bonuses or dividends. One additional benefit of participating whole life insurance policies is that insurance companies that are also mutual companies who demutualize in the future to raise capital, would provide a demutualization benefit to.

If a policyholder isn't looking for dividends and wants consistent premiums, this type of policy is best. This is opposite to participating life insurance where policy owners could get some dividends based on. The most common type of participating life insurance is whole life insurance.

A nonparticipating policy does not have the right to share in surplus earnings, and. A participating policy enables you as a policy holder to share the profits of the insurance company. An easy definition of non participating whole life insurance could simply be any whole life insurance policy that does not pay policy dividends.

All participating life insurance is whole life insurance, but not all whole life insurance is participating life insurance. One of the most important aspects to consider is getting a: If the insurer has a.

The U.S. spends more on health care than any other country

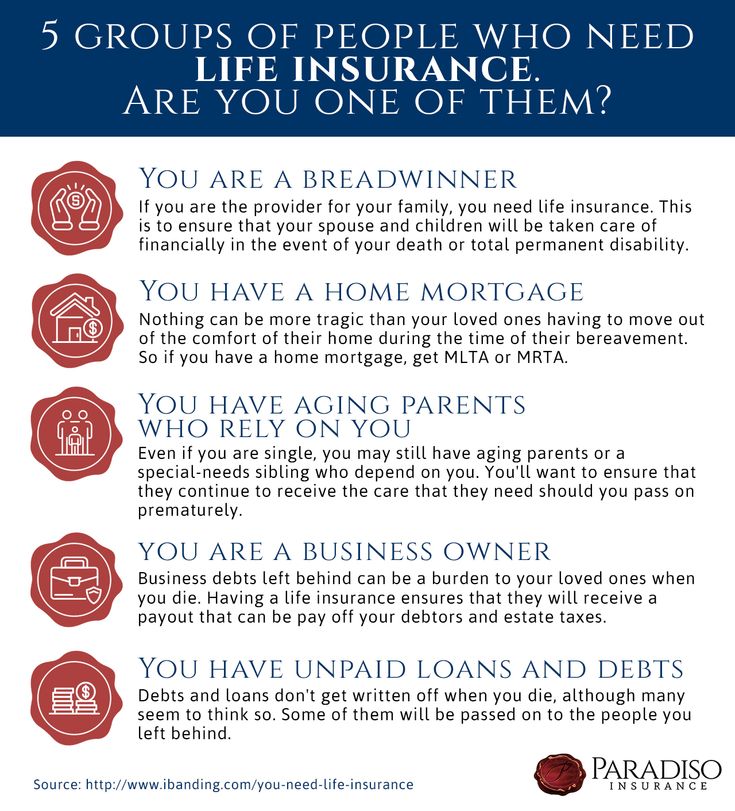

Connecticut Life Insurance Policies Paradiso Insurance

The Future of Insurance Life insurance quotes, Life

Pin by jodyfabrefinancialadvisor on Quotes & Sayings

4 Types of Life Insurance; Understanding your Insurance

LIC Jeevan Umang Plan (845) Details LIC Jeevan Umang

The Best Life Insurance Policies Life insurance policy

LIC Jeevan Umang New Whole Life Plan Features

Non medical life insurance, easy and fast. Run your own

complete protection for your family Life insurance agent

There are many different types of life insurance policies

Three in 10 or 35 million American have no life insurance

Tips for insurance InsuranceTips

Actuarial Science Profit Testing Life insurance policy

JEEVAN LABH PLAN in 2020 Life insurance facts, Life

Just a few of these savings strategies could pay for your

Growth ensured for individual life insurance market. The

The importance of life insurance, whole vs. term policy

What is the difference between term and whole life

Post a Comment for "Non Participating Whole Life Insurance Policy"